-

Đó là mô hình “Thu gom rác thải nhựa từ biển vào bờ, biến rác thành tiền” của Hội Liên hiệp Phụ nữ (LHPN) xã Bình Minh, huyện Thăng Bình (Quảng Nam) triển khai thực hiện. Mô hình này không chỉ góp phần bảo vệ môi trường sinh thái biển mà còn hỗ trợ sinh kế và trợ giúp khó khăn đối với người nghèo của địa phương.

-

(TN&MT) - Đó là yêu cầu của Thứ trưởng Bộ Tài nguyên và Môi trường (TN&MT) Võ Tuấn Nhân tại Hội thảo “Đầu tư xử lý chất thải nhựa Việt Nam, cơ hội và thách thức” do Quỹ Bảo vệ Môi trường Việt Nam và Hiệp hội nhựa Việt Nam phối hợp tổ chức vào ngày 5/10, tại TP.HCM. Hội thảo có sự tham gia của các cơ quan quản lý nhà nước, các chuyên gia, nhà khoa học trong nước và quốc tế, đặc biệt là sự tham gia của đông đảo các doanh nghiệp hoạt động trong lĩnh vực sản xuất nhựa và tái chế chất thải nhựa.

(TN&MT) - Đó là yêu cầu của Thứ trưởng Bộ Tài nguyên và Môi trường (TN&MT) Võ Tuấn Nhân tại Hội thảo “Đầu tư xử lý chất thải nhựa Việt Nam, cơ hội và thách thức” do Quỹ Bảo vệ Môi trường Việt Nam và Hiệp hội nhựa Việt Nam phối hợp tổ chức vào ngày 5/10, tại TP.HCM. Hội thảo có sự tham gia của các cơ quan quản lý nhà nước, các chuyên gia, nhà khoa học trong nước và quốc tế, đặc biệt là sự tham gia của đông đảo các doanh nghiệp hoạt động trong lĩnh vực sản xuất nhựa và tái chế chất thải nhựa.

Germany is the engine that drives the European economy — and when it comes to the plastics industry, German machinery is a potent force, an export-driven dynamo whose technology is admired the world over.

VDMA, the German Engineering Federation — through its German Plastics and Rubber Machinery Association — represents the sector that was on full display this week at Fakuma 2014. Thorsten Kühmann, managing director of the association, answered questions posed by Plastics News senior reporter Bill Bregar about the economies of Germany and Europe, export markets and “green” issues.

Machinery demand is brisk in Germany and Europe, Kühmann said. That sets the backdrop for Fakuma 2014.

In 2006, Kühmann was named head of VDMA, as well as secretary general of Euromap, the European Committee of Machinery Manufacturers for the Plastics and Rubber Industries. Both VMDA and Euromap are based in Frankfurt, Germany.

Before moving to plastics machinery, Kühmann had been deputy managing director of the mining equipment trade group at VDMA. He was born in Brazil to German parents, and grew up in Kenya — giving him a global outlook. Before joining VDMA, Kühmann, a lawyer, worked for a small American consulting firm.

Q: In June, VDMA reduced its forecast, predicting a 3 percent sales gain for 2014. VDMA also has said it expected a 4 percent increase in 2015. Has your outlook changed since that time?

Kühmann: For 2014, we are anticipating a drop of 1 percent, and for 2015 we still predict growth of 4 percent.

Q: At that June mid-year press briefing, VDMA officials said machinery sales were strong in Germany and in eurozone, while non-eurozone European countries were down 1 percent. Is that still the case? How is German demand for machinery going right now?

Kühmann: Orders from German clients continue to grow on a high level. Their increase from January through July 2014 was 22 percent compared to 2013. Euro countries have climbed by close to 9 percent whereas orders placed by overseas customers have slowed down by 2 percent in the same period.

Q: Can you give a breakdown of export market countries — from biggest to smallest? What is the most up-to-date information?

Kühmann: China remains the top destination for German exports of plastics and rubber machines, although deliveries have dropped by close to 8 percent from January through June 2014 compared to first half year 2013.

The United States (at plus 0.1 percent) remains stable No. 2 on a high level, followed by Poland (10. 2 percent) climbing from rank four to three. Russia dropped back significantly (-36.5 percent) falling to rank four on the export list. Deliveries to the Czech Republic (52 percent), France (-6.6 percent) and Italy (18 percent) reach roughly the same volume as Russia. Ranks eight to 10 go to United Kingdom (-17.3 percent), Mexico (-11. 9 percent) and Switzerland (8.6 percent).

In a nutshell — German deliveries to all destinations have dropped by 5.3 percent in the first half year 2014 compared to the previous year. At the same time, local deliveries climbed by about 9 percent and compensate some export losses.

Q: Has the geopolitical turmoil over Russia and Ukraine hurt your export business to Russia in 2014? We read in the news, for example, how the conflict has negatively impacted the German automotive industry.

Kühmann: No doubt, deliveries to Russia have dropped dramatically. Interesting enough, this process began prior to the political conflict. Overall exports to Russia in 2013 rose by 6.4 for the whole year, but shrank by 33 percent in the last quarter. So the Russian economy already was in a rough shape before entering into the Ukraine conflict.

However, some export losses in business with Russia could be compensated lately by rising shipments to other Eastern European states like the Czech Republic (52 percent), Poland (10.2 percent), Belarus (173 percent) and Ukraine (63 percent).

At the bottom line exports to Europe (West and East together) have slightly climbed although the impact of Russia is significant. The relationship with Russian business partners remains strong for the German side and we sincerely hope the political issues can be solved in due time.

Q: Turning to currency issues — the European Central Bank cut interest rates at its September meeting, and the euro has weakened quite a bit as a result. Has this helped German machinery makers to export out of the eurozone?

Kühmann: No, not significantly. Although the euro has weakened — the European currency still remains too strong in comparison to other currencies, such as the U.S. dollar. An exchange rate of about one-to-one compared to the dollar would be regarded as appropriate.

People get used to an overvalued euro and thus believe European exports must boost as soon as the exchange rate drops under $1.30 per euro. Besides, the slight weakening of the euro has started only a couple of weeks ago and the impact on machine business cannot be measured in such a short time.

Green Issues

Q: VDMA members launched the Blue Competence effort in 2012, and promoted it at K 2013. Can you give some updates? How is it going? How many companies are involved now?

Kühmann: A total of nearly 400 firms have signed up to this initiative, 55 of which are members of the Plastics and Rubber Machinery Association. That makes our industry a trailblazer among German plant and machinery manufacturers when it comes to environmental protection, conservation of resources and management efficiency.

Q: How much energy can still be saved by introduction of new technology? How can companies market the energy efficiency of their products?

Kühmann: A study by Euromap concludes that further efficiency gains — in some cases as much as 50 percent — by 2020 are a realistic proposition, especially by improving drives.

Most of the technology is available today already; the reduction of energy consumption can be achieved by replacement of old machines. However, converting companies are challenged by too much and inconsistent information about energy consumption. In many cases apples and oranges are compared. Therefore Euromap has installed energy measurement standards which bring more transparency and competence to the issue (www.euromap.org).

As a supplement Euromap is about to introduce an energy label for plastics and rubber machinery. The development of a common and neutral label will enable manufactures to present the efficiency classes of their machines transparently and comparably for customers. In contrast to the energy label of the EU (such as, for refrigerators), the Euromap label is voluntary.

The detailed specification of the Euromap energy efficiency label is available as a free download for public advance information.

Q: Energy costs, of course, are very important in Germany’s manufacturing economy. Has VDMA taken a position on Germany’s aggressive push into renewable energy?

Kühmann: The German “Energiewende” is unique worldwide. It started with the ecological movement in the early 80s. The process was fueled by the disasters of Chernobyl and Fukushima.

The impact of Fukushima on the German society and politics may be compared with Lakehurst, N.J., and the 1937 explosion and crash of the Hindenburg, and the consequence for airships in the United States. Given this, there is no alternative for the German industry as to support this process. Therefore VDMA is a partner for the success of “Energiewende.”

However, the process needs to be organized in a predictable way. The industry depends on a reliable cost structures and safe supply of energy at any time. As technology suppliers we do the utmost to design our machines as energy efficient as possible and to behave as transparently as possible in this regard.

We trust “Energiewende” is challenging but makeable for the German industry. The technological boost for enabling this process may lead to an interesting export opportunity.

soure of Plastic news

- Khó khăn của ngành nhựa trong năm 2013

- Giá nhập khẩu chất dẻo nguyên liệu từ thị trường Thái Lan tăng

- Nhựa sinh học từ thực vật an toàn với môi trường

- Ý tưởng triệu USD từ nắp cốc cà phê

- XUẤT KHẨU SẢN PHẨM NHỰA TỚI THỊ TRƯỜNG MỸ TĂNG 12.8%

- Dùng đồ nhựa đúng cách để bảo vệ sức khỏe

- Diễn biến thị trường Nhựa 2 tuần cuối tháng 8/2013

- Diễn biến thị trường Nhựa và chất Dẻo 2 tuần đầu tháng 8/2013

- NHẬP KHẨU CHẤT DẺO NGUYÊN LIỆU ĐẠT 2 TRIỆU TẤN

- KỶ LỤC THẾ GIỚI: SỢI DÂY TẾT TỪ NẮP CHAI DÀI NHẤT

- Xuất khẩu sản phẩm nhựa tới Hoa Kỳ tiếp tục đạt mức cao

- Việt Nam khó tăng trưởng tốt giữa một châu Á suy giảm

- HẠT NHỰA PE

- Chọn loại nhựa nào để ép khuôn

- Có thể sản xuất nhựa sinh học từ vỏ hạt điều

- GIÁ PP, PE DIỂN BIẾN TRÁI CHIỀU TẠI CHÂU Á VÀ CHÂU ÂU

- Tình hình xuất khẩu sản phẩm nhựa tuần từ 18/10 - 25/10/2013

- Doanh nghiệp Ấn Độ có nhu cầu nhập khẩu sản phẩm nhựa - PVC Flex Banner

- Quốc hội chốt kinh tế 2014 tăng trưởng 5,8%

- Bảng phân tích SWOT ngành nhựa.

- CÁC CHÀO GIÁ HDPE MỨC THẤP NHẬP KHẨU TẠI THỔ NHỈ KỲ BIẾN DẦN

- Các thương vụ PVC tại Đông Nam Á đã đạt được với mức giá hạ

- “Việt Nam khó tăng trưởng tốt giữa một châu Á suy giảm”

- Lương tối thiểu tại doanh nghiệp tăng lên 1,9 triệu đồng

- Cuộc chiến khốc liệt giữa pallet gỗ và pallet nhựa

- Giá điện tăng dưới 10%, EVN được tự quyết

- THAM KHẢO GIÁ HẠT NHỰA PP TUẦN 46 - 47/2013

- Thị trường PE Việt Nam

- Hãng NEC sản xuất nhựa sinh học từ vỏ hạt điều

- CPI cả nước tháng 11 tăng 0,34%

- Lương, thưởng Tết cho người lao động giảm

- Thị trường PVC Việt Nam

- EVN thu hơn 7 tỷ đôla tiền bán điện

- Đề xuất tỷ giá linh hoạt hơn

- GIÁ CẢ PP, PE TĂNG TẠI THÁI LAN

- Thị trường PE Việt Nam tuan 49

- SEA Games 27: Đoạt 40 HC Vàng, Việt Nam qua mặt Myanmar

- Kịch bản nào cho vĩ mô 2014?

- HLV U23 Việt Nam xin lỗi vì đã làm CĐV thất vọng

- SEA Games ngày 19/12: Chàng thượng úy nghèo lại giành HC Vàng

- Bội thu HC Vàng, Việt Nam vững vàng thứ hai

- CUNG KHAN HIẾM KHIẾN NGƯỜI BÁN TÌM CÁCH NÂNG GIÁ PE THÊM TẠI Ý

- Festival Hoa Đà Lạt lần thứ 5 (2013 – 2014)

- Sóng đánh toàn bộ xác 7 học sinh vào bờ biển Cần Giờ

- Thủ tướng New Zealand: Việt Nam phát triển vượt bậc như rồng

- "Chênh vênh" thưởng Tết giáo viên

- Nguyên liệu nhựa tăng 30 %

- Vụ nổ đài cát-xét: Món quà sinh nhật bí ẩn

- Land Rover Defender độ nội thất hạng sang

- Tác giả Flappy Bird bất ngờ tuyên bố gỡ trò chơi

- Công Ty TNHH MTV Nhựa Thiên Quốc bán hạt nhựa nguyên sinh

- TỔNG QUAN NGÀNH NHỰA THẾ GIỚI

- Ajinomoto Việt Nam đạt Doanh nghiệp Kinh tế xanh 2013

- Tổng quan :Thị trường PP Việt Nam tuần 11- 2014

- Doanh nghiệp: Indonesia sẽ không áp dụng thuế chống bán phá giá PET

- Mỹ rà soát thuế chống bán phá giá túi nhựa PE của Việt Nam

- Nhập khẩu PET, PP và PVC tăng mạnh từ thị trường Đài Loan

- Thị trường PP, PE Việt Nam gia tăng do nguồn cung thấp

- Cuộc chiến thầm lặng ở ngành nhựa

- Quả bóng nhựa Trung Quốc chứa chất độc hại

- Thông báo

- Công Ty Cổ Phần Visual Plastic đang nhận gia công sản phẩm

- Công Ty Cổ Phần Visual Plastic nhận gia công sản phẩm

- Triển lãm nhựa TAIPEI PLAS 2014

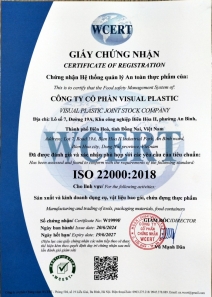

- Xây dựng hệ thống sedex tại Công Ty Cổ Phần Visual Plastic

- DOANH NGHIỆP NGÀNH NHỰA: ĐANG CÓ NHIỀU LỢI THẾ

- Nguồn nắp nhựa trong tương lai

- Quy hoạch phát triển ngành nhựa Việt Nam đến năm 2020

- Việt Nam xuất khẩu hạt nhựa PP đầu tiên ra thị trường

- Xuất khẩu nhựa sẽ đạt kỷ lục 1 tỷ USD

- Hãng NEC sản xuất nhựa sinh học từ vỏ hạt điều

- Trung Quốc chào tăng giá nhựa PP

- Tình trạng ế ẩm kéo dài tại thị trường PS Trung Quốc và Đông Nam Á

- Việt Nam nhiều cơ hội xuất nguyên liệu nhựa sang Thổ Nhĩ Kỳ

- Nhựa gia dụng Việt Nam bỏ lỡ phân khúc cao cấp

- Nước ép đóng hộp 100% thiên nhiên?

- Arburg sẽ tổ chức sự kiện “Những Ngày của Bao bì” lần đầu tiên

- Trái đất ra sao nếu túi nilon biến mất?

- Mỹ: Tiểu bang California sẽ cấm dùng túi nylon

- Công nghê mới tự động phân loại các loại nhựa để tái chế.

- Thị trường polymer Châu Âu bắt đầu ổn định lại trong tháng 10

- Plastic caps essential to health, beauty end market

- Recyclers see progress on shrink-sleeve labels for PET bottles

- Ngành nhựa hướng tới sản phẩm thân thiệt

- Tái chế lọ nhựa thành chậu hoa nhỏ xinh cực bắt mắt

- Biến áo sơ mi thành áo váy cho bé thật đơn giản

- Doanh nghiệp ngành nhựa được chủ động lựa chọn lãi suất vay vốn

- TPC, DPC: 2 doanh nghiệp ngành nhựa báo lãi quý 1/2014

- Hướng đi cho ngành nhựa tái chế

- Hướng đi nào cho M&A ngành nhựa?

- Chưa bao giờ DN lại thờ ơ với vốn tín dụng như hiện nay

- EU điều tra về túi nhựa nhập khẩu từ Trung Quốc

- Giá dầu thế giới giảm mạnh

- CHẤT LIỆU NHỰA AN TOÀN

- NHỮNG KÝ HIỆU NHỰA THƯỜNG DÙNG (nguồn tupperware)

- Nhiều công nghệ tiên tiến nhất cho ngành nhựa và cao su VN

- Cơ hội đầu tư đổi mới công nghệ

- Nhiều công ty đa quốc gia đang chuyển đầu tư sang Việt Nam

- Unifi joins UNC to support recycling on campus

- SIPA collaborates on innovative lightweight pressure vessel liners made from PET

- Nhựa gia dụng: Hàng Việt chiếm lĩnh thị trường

- Tạo lợi thế cho xuất khẩu sản phẩm nhựa

- Plastic Feedstock Supply

- Winners of the 2014 Innovation in Plastics Recycling Awards announced

- Triển lãm thiết bị công nghiệp ngành nhựa và cao su

- Recycled soft drink bottles used for environmentally friendly stroller

- Xuất khẩu nhựa tăng trưởng ổn định

- Resin Pricing

- Công nghệ tái chế túi plastic thành nhiên liệu

- Parx Plastics Wins World Technology Award for Materials

- Kiến nghị giữ mức thuế 0% cho chất hóa dẻo DOTP nhập khẩu

- Domestic demand for plastics industry goods grew 6.5 percent in 2013

- Vật liệu mới từ thiên nhiên thay thế chất dẻo

- Tìm hướng phát triển công nghiệp hỗ trợ ngành nhựa – cao su TP. HCM

- Sipa acquires Automa’s PET bottle business

- Plastics save energy

- Giá dầu tiếp tục rơi về sát 55 USD/thùng

- Tổng quan ngành hàng nhựa Việt Nam - Phần 2

- Thị trường cung cấp nguyên liệu nhựa cho Việt Nam 2 tháng đầu năm 2014

- Merry Christmas and Happy New Year!!!

- Giá xăng dầu sẽ giảm trong nay mai?

- Tổng hợp dụng cụ sáng tạo được tái chế từ vỏ chai nhựa cũ (P.1)

- Plastic packaging gaining momentum in Mexico

- Nhựa tự hủy chế từ vỏ trấu

- Tết 2015: Tiền lì xì USD bằng nhựa hút khách

- Giá dầu tiếp tục lập đáy mới, thấp nhất kể từ tháng 4/2009

- Ngành nhựa - cao su: Phát triển trong thế khó

- Những quan niệm sai lầm về phá giá VND

- VN xếp thứ 5 trong các nước đầu tư nhiều vào Campuchia

- Từ 16h30 chiều 6/1, giá xăng giảm 310 đồng/lít

- Ngành nhựa lạc quan

- Mục tiêu xuất khẩu của Công nghiệp nhựa Việt Nam

- Lạ mắt với thực đơn bằng... nhựa của nhà hàng Nhật Bản

- ĐỂ NGÀNH NHỰA PHÁT TRIỂN BỀN VỮNG

- Người tiêu dùng vẫn thiệt thòi dù xăng dầu giảm giá sâu

- KINH TẾ 80% nguyên liệu ngành nhựa phải nhập khẩu

- Tái chế chai nhựa thành giấy

- Lợi ích cho nền kinh tế vượt xa mức hụt thu khi giá dầu giảm

- Quy hoạch phát triển ngành nhựa đến năm 2020

- “Giá dầu có thể giảm xuống mức 20 USD/thùng”

- Tiền lương 2015 và tin vui đầu năm mới

- PVN sẽ không đầu tư mạnh vào khai thác dầu

- Cơ hội từ giá dầu giảm

- Cơ hội lớn cho ngành công nghiệp nhựa

- Lương tối thiểu phải tăng từ 18-19% mỗi năm

- Bỏ tiền tỷ mua hạt nhựa, bị TQ lừa bán đá dăm

- Thực hư tin giá xăng sắp tăng mạnh?

- Tăng giá điện, doanh nghiệp lại lo

- Giá xăng tăng hơn 1.600 đồng từ 15h chiều nay

- Thách thức ngành bao bì trong năm nay

- Nhựa đường làm từ cây xanh

- Việt Nam sắp trở thành “con hổ kinh tế mới” của châu Á

- Mẹo đánh bay mùi hôi của đồ nhựa cực đơn giản

- Dưa hấu Quảng Nam bị ép giá 1.000 đồng/kg tại ruộng?

- Đến thời dân Việt xài 100% ôtô nhập giá rẻ?

- Công nghiệp ôtô - 20 năm vẫn một ngã ba đường

- Masan Group bất ngờ “quay lại” sở hữu Proconco

- Chính sách mới có hiệu lực từ tháng 5/2015

- TỰ TIN DÙNG TUPPERWARE

- CÁCH PHÂN BIỆT MỘT SỐ LOẠI NHỰA THÔNG DỤNG

- KỸ THUẬT THỔI NHỰA TẠI VIỆT NAM

- Giá xăng tăng kỷ lục(5/5/2015)

- Doanh nghiệp đề nghị tăng giờ làm thêm, Bộ Lao động phản đối

- Hơn 320 doanh nghiệp tham gia triển lãm ngành nhựa và cao su

- Bộ Công Thương vừa có quyết định tăng giá xăng dầu từ 20h 20.5.2015

- Ấn tượng gạo, tỏi trong đàm phán thương mại với Hàn Quốc

- Samsung ngừng sản xuất TV tại Thái Lan

- Nguy hiểm khi dùng đồ nhựa đựng thực phẩm

- Bí quyết để có được thành công trong khâu bán lẻ

- Doanh nghiệp VN thêm cơ hội tiêu thụ hàng hóa

- KINH TẾ “Nhà đầu tư Hoa Kỳ háo hức ở VN là chưa từng thấy”

- Giá dầu sẽ ở ngưỡng 60 USD/thùng trong năm 2015 và 2016”

- Nhật Bản trồng siêu cao lương tại Việt Nam

- 10 nguyên tắc thành công của vua thép Andrew Carnegie

- 10 phát ngôn để đời về nghệ thuật đàm phán

- Bốn nguyên tắc khởi nghiệp kinh doanh

- Nói thật hay để bán hàng thật dễ

- Năm chiến lược để có thể đo lường hiệu quả marketing

- Thế nào là một quốc gia vỡ nợ

- Mỹ chính thức thông qua TPA

- Ngân hàng Nhà nước mua lại GPBank với giá 0 đồng

- Hiến kế xây Trung tâm Hội chợ Triển lãm Quốc gia

- Hàng loạt dự án đầu tư lớn rút khỏi VN: Chớ thấy tỷ đô mà hoa mắt

- Cục Thuế TP HCM xin lỗi doanh nghiệp bị bêu tên oan

- Trở thành giám đốc marketing dù không có bằng đại học

- 4 nguyên tắc ra quyết định của Richard Branson

- ĐỔI 35 TRIỆU TỶ ĐÔLA ZIMBABWE LẤY 1 USD

- Doanh nghiệp được giảm 420 giờ nộp thuế

- VCCI: 30% doanh nghiệp chi tiền 'lót tay' cho cán bộ thuế

- Doanh nghiệp "ngấm đòn" tỷ giá

- Thu nhập công nhân khó tăng theo lương tối thiểu

- Chính sách tiền tệ Việt Nam thêm một phen thử thách

- Cổ phiếu BIDV bị bán mạnh sau khi rời danh mục Vietnam ETF

- 14 lời thoại phim truyền cảm hứng cho doanh nhân

- Những sai lầm tài chính dễ mắc phải khi khởi nghiệp

- Tập đoàn Singapore đầu tư 13 triệu USD vào nước chấm Nam Dương

- Xuất khẩu gạo tháng 10 giảm kỷ lục

- Các nhà rang xay thế giới cảnh báo cà phê Việt Nam

- Gần 300 doanh nghiệp dự triển lãm nhượng quyền thương hiệu

- Masan muốn mua nước khoáng Quang Hanh

- Người Việt dè dặt chi tiêu

- Sản xuất nắp phi 28 (cổ 1810 & 1881)

- 3 bí quyết làm giàu của Warren Buffett

- Doanh nghiệp rót hơn 625 triệu USD ra nước ngoài sau 10 tháng

- Ngành nhựa đối mặt với nhiều thách thức hội nhập

- 11 điều cần biết về FTA Việt Nam - EU

- Ngành nhựa trước sức ép hàng Thái

- Công ty nhựa hàng đầu Thái Lan sắp mở thêm chi nhánh ở Việt Nam

- Để đứng vững trước hội nhập

- Kiếm bộn tiền từ những thứ bỏ đi

- Nhập khẩu điều thô của Việt Nam tăng mạnh

- Dành 10 triệu USD xây dựng nhà máy sản xuất túi nhựa phân hủy

- Xuất khẩu nhựa tăng mạnh

- Quy hoạch phát triển ngành nhựa đến năm 2020

- Nhận biết các loại nhựa để sử dụng đúng cách

- Nhu cầu thị trường PVC toàn cầu sẽ gia tăng trong 6 năm tới

- Nới điều kiện nhập khẩu máy móc cũ

- 80% nguyên liệu ngành nhựa phải nhập khẩu

- Doanh nghiệp sản xuất nhựa: Tự bán hoặc bị mua

- Giá dầu khép tuần ở mức thấp nhất kể từ cuộc khủng hoảng 2008

- Giáng Sinh 2015 An Lành!

- Kinh tế Việt Nam ra sao khi giá dầu về 30 USD một thùng

- USD ngân hàng kịch trần, tự do chạm 22.740 đồng

- Ngành nhựa loay hoay tìm nguyên liệu

- Việt Nam xuất khẩu hạt nhựa PP đầu tiên ra thị trường

- Doanh nghiệp thêm gánh nặng chi phí đầu năm 2016

- Không khí Noel tràn ngập thủ đô

- Tổng quan ngành hàng nhựa Việt Nam - Phần 2

- Berry Plastics expanding in Tennessee

- Oil, gas prices continue to make economic news

- Rotomolding trends for 2016

- Nhập khẩu polyethylene tăng 15-18% trong 2016

- Kịch bản nào cho giá dầu năm 2016?

- Cabin crew, doors to plastic please

- Ngành nhựa: Tiềm năng và nỗi lo chi phí

- EuroPlast back in business under new owner

- Giá xăng dầu tiếp tục giảm, thấp nhất trong vòng 5 năm qua

- Hội nhập thành công xoá nỗi đau tụt hậu

- Năng suất lao động: Vì sao Việt Nam luôn đứng cuối bảng?

- Techcombank ra mắt sản phẩm chuyên biệt cho doanh nghiệp ngành nhựa

- Dự cảm kinh tế Việt Nam 2016

- Giá dầu xuống đáy 12 năm

- PET bottle resin down 1 cent

- Recycler wins approval for food-contact polystyrene

- Using plastic to save trees

- Doanh nghiệp công nghiệp hỗ trợ “ngóng” ưu đãi

- Ngành nhựa thiếu quy hoạch

- Khó khăn trong phát triển ngành nhựa

- Tập đoàn Ajinomoto hướng đến top 10 toàn cầu

- Hàng Việt thua đứt hàng Thái, Lào, Campuchia?

- Ngành nhựa Việt Nam đang chịu sức ép thâu tóm từ doanh nghiệp ngoại

- Cuộc chiến M&A và cạnh tranh trên sân nhà của ngành nhựa

- Tin tức Áp lực thuế đè nặng doanh nghiệp nhựa

- Sức hút của ngành nhựa trong năm 2016

- Thực trạng ngành nhựa Việt Nam

- Xăng dầu đồng loạt tăng giá từ 19 giờ ngày 5.12

- Lock&Lock vào top 10 sản phẩm, dịch vụ Tin & Dùng 2016

- 6 hiệp hội muốn 'truy' đơn vị đứng sau khảo sát nước mắm

- Xăng trước áp lực tăng giá mạnh hôm nay

- Ngành nhựa đang là “đích ngắm” của nhiều nhà đầu tư nước ngoài

- Doanh nghiệp ngành nhựa: Lạc quan hơn vào xuất khẩu 2017

- Doanh nghiệp nhựa năm 2017: Cẩn trọng với sự dòm ngó của người Thái

- WB nâng dự báo giá dầu thế giới năm 2017

- Thủ tướng cấm công chức bỏ việc đi lễ hội sau Tết

- Kim ngạch xuất khẩu nhựa dự báo tăng trưởng 3,5 - 6%

- Cập nhật ngành nhựa- VCBS

- Giá xăng tăng lần đầu tiên trong năm 2017

- Chuẩn bị xây dựng cao tốc Bắc Nam qua 20 tỉnh, thành

- Xăng có thể giảm giá hôm nay

- Doanh nghiệp nhựa đẩy mạnh đầu tư nhằm tránh bị thâu tóm

- Doanh nghiệp dầu khí 'lách khe cửa hẹp'

- Masan nhận thêm 250 triệu USD từ đối tác ngoại

- Hà Nội tổ chức triển lãm quốc tế về công nghiệp nhựa, bao bì

- Các địa điểm đi chơi dịp lễ 30/4- 1/5 tuyệt nhất miền Bắc

- Mexico chế tạo thành công nhựa từ hạt quả bơ

- Ngành nhựa đổi mới công nghệ sản xuất

- Việt Nam - Nhật Bản ký các hợp đồng trị giá 22 tỷ USD

- Visual Plastic XANH

- Giá xăng có cơ hội giảm ngày mai

- Công ty Á Mỹ Gia sắp về tay Earth Chemical với giá 1.800 tỷ đồng

- Triển vọng ngành nhựa 2017: Giá hạt nhựa PE, hạt nhựa PP, hạt nhựa PVC

- Nhìn ra cơm bằng nhựa, cải bắp

- Xăng tăng gần 600 đồng một lít

- Nhựa sinh học làm từ vỏ tôm

- 18 quốc gia tham gia triển lãm quốc tế công nghiệp nhựa và cao su 2017

- Giá xăng có thể tiếp tục tăng vào ngày mai

- Nhựa làm từ thực phẩm: Liệu có phải một ý tưởng hay?

- Nhiều doanh nghiệp hướng đến mục tiêu phát triển bền vững

- Xăng tăng hơn 400 đồng mỗi lít

- Masan muốn chi 1.700 tỷ mua toàn bộ Vinacafé Biên Hòa

- HỘI THI TAY NGHỀ 2017

- MERRY CHRISTMAS 2017

- THÔNG BÁO NGHỈ TẾT DƯƠNG LỊCH

- Algeria sẽ tạm ngừng nhập khẩu 851 mặt hàng kể từ tháng 1/2018

- Người Thái đã mua những gì ở Việt Nam?

- Doanh thu Kido tăng gấp đôi nhờ hợp nhất hai công ty dầu ăn

- Điện, xăng dầu đẩy chỉ số giá tiêu dùng tăng

- Công đoàn gửi tặng quà Tết Nguyên Đán năm 2017 đến CBCNV Nhà máy

- THÔNG BÁO NGHỈ TẾT NGUYÊN ĐÁN 2018

- Báo cáo thị trường hạt nhựa các tuần từ 01/01/2018 đến 13/01/2018

- Masan Consumer Holdings và Masan Consumer có tổng giám đốc mới

- Nhựa Việt Nam rộng đường xuất khẩu

- Lũ lụt cuốn trôi 43 tỷ mảnh nhựa ra biển.

- Giá PET tại Đông Nam Á duy trì tăng trong khi giá MEG giảm

- Kim ngạch xuất khẩu nhựa dự báo tăng trưởng 12-15%

- Xăng tăng gần 600 đồng một lít

- Doanh nghiệp nhựa yếu thế ở sân nhà

- Các nhà khoa học bước đầu tìm ra cách tái chế nhựa vô hạn lần

- Tăng trưởng GDP quý II dự báo dưới 5%, gần thấp nhất trong 13 năm

- Masan vào top 2 nhà sản xuất được chọn mua nhiều nhất

- Bảo vệ môi trường: Đức bác đề xuất đánh thuế bao bì nhựa đóng gói

- Nguyên liệu nhựa xuất khẩu chủ yếu sang Trung Quốc, giá rất rẻ

- Nguyên liệu nhựa xuất khẩu chủ yếu sang Trung Quốc, giá rất rẻ

- Polymer Marketing Vietnam khai trương công ty đầu tiên tại Việt Nam

- Starbucks tuyên bố ngừng sử dụng ống hút bằng nhựa

- Sản xuất nhựa sinh học từ rơm rạ

- Cảng Cái Mép tìm chủ nhân 4 lô hàng phế liệu nhựa quá hạn

- Hàn Quốc cấm sử dụng túi nilon dùng một lần tại các siêu thị

- Túi nilon làm từ vỏ tôm, cua và thực vật

- Tại sao ngành nhựa không tận dụng nguyên liệu trong nước?

- Biến rác thành tiền

- Kho nhựa tái chế ở Hưng Yên chìm trong khói lửa

- Cháy lớn xưởng sản xuất đồ nhựa ở Sài Gòn

- Ngành tái chế nhựa phải ưu tiên sử dụng nguyên liệu trong nước

- Nhật Bản cam kết giảm rác thải nhựa

- Chỉ được nhập khẩu phế liệu nhựa đã làm sạch tạp chất

- Nhận biết các loại nhựa và khả năng tái chế chúng

- Liên Hiệp quốc: Thế giới có thể cắt giảm 80% ô nhiễm nhựa vào năm 2040

Copyright © 2013

Công Ty Cổ Phần Visual Plastic – Visual Plastic Joint Stock Company

Địa chỉ: Lô số 07, Đường 19A, KCN Biên Hòa II, P. An Bình, TP. Biên Hòa, Tỉnh Đồng Nai

Điện thoại: (84-0251) 3992 284 - Fax: (84-0251) 3992 287

Hotline: 0933.500.063 - 0903.608.012 (Mr. Sơn), 0901.554.367 (Ms Thu Mai)

0799518769( Ms.Lê Mai)

0799518769( Ms.Lê Mai)